In general, investing in stocks can be very profitable over time, but there is also a chance of losing all the money that was put in. So, our advice is always to talk to investment experts who are listed in the official registers of each country or to talk to banks you trust.

Still, we can’t help but notice how profitable and exciting it is to invest in the e-sports industry as a whole, as well as how quickly companies in this field are growing and making money.

The State of The Esports and Gaming Markets Over the Years

It was thought that the esports business would bring in about $950 million in 2021 and about $1.3 billion by the end of 2022. You can learn more about the 240 million fans around the world from Videogames Europe Esports and the Entertainment Software Association (USA).

In the coming years, this business is likely to keep growing. All of us can see that big companies in the field have recently started sponsoring a number of sports. Take football as an example. The English Premier League, the Spanish La Liga, and the Italian Serie A all have a large number of teams that receive support from video game companies.

The growth of sports and video games will always go hand in hand with the esports business. Two very important events that happened in the last few months of 2023 and 2024 show that even big names in the IT business are becoming more interested in the field:

Microsoft Corp. paid a record $68.7 billion to buy Activision Blizzard, one of the biggest names in e-sports. It was the most expensive buy Microsoft has ever made. The deal was finalized in October 2023. Two things are important to keep in mind: first, Microsoft is the world’s biggest capitalized company as of the first half of 2024; second, Activision Blizzard was officially delisted from the stock exchange on October 13, 2023, which means that it can no longer be bought on the stock exchange.

The stock price of Nvidia, one of the biggest tech companies in the world, which makes graphics computers for video games, has set new highs. It has gone up over 30% in February 2024 alone and over 250% in the past year, showing how excited people are about the sector.

The 5 Most Interesting Sports and Gaming Stocks to Invest in This Year

We chose five stocks that look like they will do well on the market, at least in the first half of 2024. We picked these stocks by looking at important things like the market value of the company and how the stock price has done in the past few months. And it’s clear that we haven’t forgotten about these companies’ plans for the future.

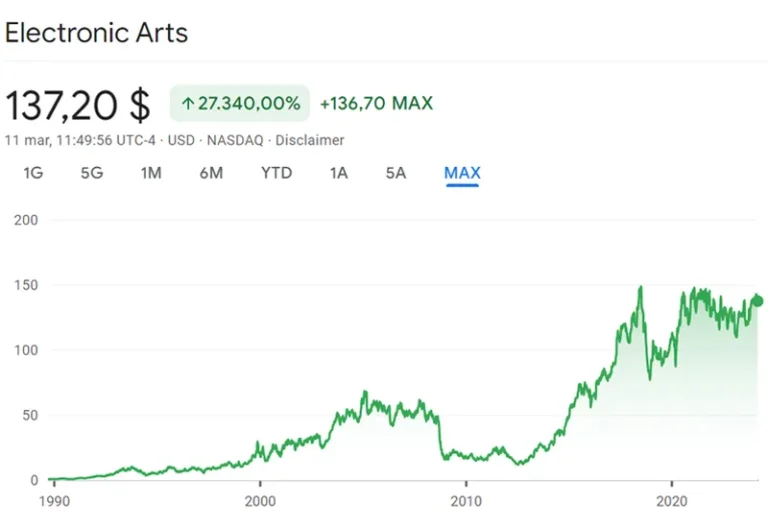

1. Electronic Arts

Electronic Arts, Inc. is a company in California that makes, sells, and gives away video games. It’s on the NASDAQ and is worth more than $37 billion on the market.

It has been a good company to buy in in the past. Its balance sheet shows that it has more cash on hand than debt, and for the past four years, it has raised its income.

In the last few quarters, sales have continued to rise, though at a slower rate. The company is also implementing a restructuring plan to cut costs, including those related to staffing.

In the past year, the stock has gone up more than 26%. We think it can still do well, but only in the long run.

Related: How to Play Genshi Impact Cross-Platform Games? Is Genshi Impact Cross-Platform?

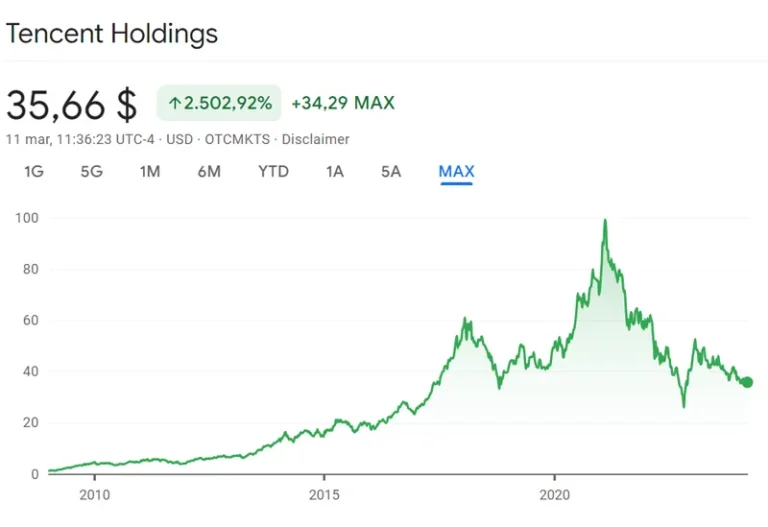

2. Tencent

One of the biggest tech companies in the world is Tencent Holdings, which is based in China. The company is based in Hong Kong and has a market capitalization of about $330 billion. It is the biggest video game company in the world by sales.

You may know about WeChat, which is like WhatsApp in Asia, and Fortnite, which is one of the most famous video games in the world. Well, Tencent owns both of them. To be exact, Fortnite is 40% owned by Tencent.

After years of huge sales growth, the company’s income has been going down in recent months, and the stock price has also gone down. The price of the stock has gone up by about 20% in just one year. All of these and other factors make us think that Tencent is a good bet overall. In the next five years, for instance, we think it can do well, but there are risks.

Before you buy in China, you should always keep in mind that there are big political risks that could affect your money.

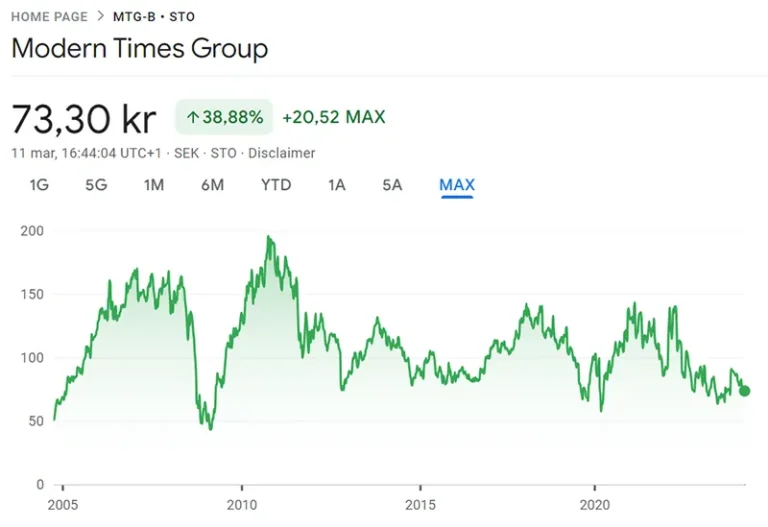

3. The Modern Times Group (MTG-B)

Modern Times Group is a Swedish company that runs radio and TV stations in Northern Europe, makes entertainment material, and sends out MTGx, which includes e-sports. With a market value of just over $9 billion and yearly sales that stay close to $1.5 billion, the company on the stock exchange looks very stable.

In the past year, the stock price has stayed the same, but it is still priced well below what it’s worth. Again, the advice is to be very careful, but in the long run, it has a great chance of working out well.

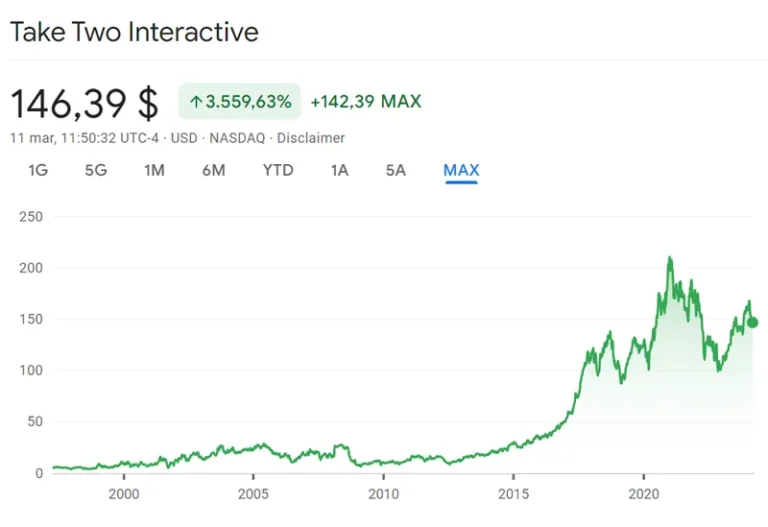

4. Two Interactive Software, Inc.

A huge name in the video game business, this US company has offices in both New York and Geneva. Eventually, in 2022, they bought Zynga for $12.7 billion. It is one of the busiest and most interesting American video game businesses, with a market value of more than $25 billion.

During the past year, the stock market has done better than 30% of the time. It can be a good long-term investment because the profits are always going up.

Related: How to Become Really Good at Playing Video Games Competitively?

5. Flutter Entertainment

The last company we had to talk about was this worldwide giant based in Ireland. Flutter Entertainment is a world giant in the gaming and sports betting industries, but it doesn’t do much in e-sports. Along with PokerStars and hundreds of other gambling and iGaming startups around the world, it runs Paddy Power, Betfair, and Betfair. It is traded in London (FLTRF) and New York (FLUT), and the market value of it is over $37 billion. Indeed, the house always wins, so why not buy it?

What Are ETFs For Sports?

An exchange-traded fund (ETF) is a collection of different company stocks that are related in some way, like being in the same industry or being in the same place.

When you buy an ETF, your money is spread out among as many companies as are in the fund, which is a good thing. The risk you take is much smaller when you invest in an ETF instead of individual companies because the risk is spread out among many companies. An ETF’s only job is to copy an underlying index, so when we’re looking for one, all we need to do is make sure it’s the right size and was released by a big foreign company.

There are a number of exchange-traded funds (ETFs) that you can buy to get stakes in companies that work in esports and other types of online games.

VanEck, the company that issued the note, is an American investment management firm that oversees assets worth nearly $80 billion, so I am sure that it is a trustworthy business.

You can see that it is an accumulation ETF with a very low yearly expense ratio. It has gained about 100% in 5 years and about 20% in 1 year, as of March 2024. If an ETF uses the letters “acc” or “c,” it means that the fund’s companies automatically reinvest any yearly dividends they pay. This creates the compounding effect that medium- and long-term investors love.

Although there are other e-sports-focused exchange-traded funds (ETFs) out there, the one we’ve already talked about is the only one that meets our standards for stability, history, and fund size.

Where and How to Buy Stocks and ETFs in Sports

If you want to buy e-sports stocks, you should first learn as much as you can about such investments. If you learn about owning stocks, like picking a good broker to buy your shares, market cap, float, and important ways to measure how much a stock is worth, like price to earnings, you can make better choices.

You should learn how to tell if the current price of a stock is a good investment or if it is too high compared to the company itself.

You can put money into e-sports or buy e-sports stocks in several ways. You can buy stocks in e-sports companies directly or in businesses that work with e-sports. If you’re serious about investing in e-sports or getting e-sports stocks, you might want to talk to a stockbroker or an investment expert who knows the business well and can help you. You can also use a brokerage that lets you take care of your finances.

How to Put Money Into Sports

Many people buy stocks through websites that help them do that. You should be able to buy stock in any e-sports or game company that is listed on a stock exchange by going to one of these sites. Platforms for trading shares cover the bigger stock markets, like the New York Stock Exchange and the London Stock Exchange.

A stock exchange is a business that is authorized to buy and hold stocks for individual investors. There are a lot of options here, and many online brokerages even charge low fees. In your country, find out which brokers can connect you to the biggest and most important markets, such as the New York Stock Exchange, the London Stock Exchange, and the Euronext trading site in Europe. In the same way, there are also foreign platforms that work in many parts of the world. The two biggest are Interactive Broker in the US and DeGiro in Europe.

Leave a Comment